After the People's Bank of China ("PBOC"), the China Securities Regulatory Commission (“CSRC”) and the State Administration of Foreign Exchange (“SAFE”) jointly issued the Announcement on Relevant Matters Concerning Further Facilitating Foreign Institutional Investors to Invest in China's Bond Market (the “Announcement”) on May 27, 2022, which promotes the opening up of both the China Interbank Bond Market (“CIBM”) and the exchange bond market, PBOC and the SAFE jointly issued the Administrative Provisions on Funds Used by Foreign Institutional Investors for Investment in China's Bond Market (the “Funds Administrative Provisions”) on November 18, 2022. In addition, relevant financial regulators and self-regulatory organizations have also issued supporting policies in the passing months.

A series of new regulations have made significant innovations from several perspectives. In this article, we will analyze some important aspects, and compare various investment channels.

1.Further Open Exchange Bond Market

In the past, foreign investors can invest in the CIBM via (a) direct investment in the CIBM (“CIBM Direct”), (b) Northbound Bond Connect, and (c) QFII/RQFII, and they can invest in exchange bond market via the QFII/RQFII scheme. The Announcement makes a further step to stipulate that foreign investors granted the access to CIBM can now invest in the exchange bond market directly or via Intra-Market Connect (defined below) as well.

(1)Directly Invest in the Exchange Bond Market

As operating rules, the Shanghai Stock Exchange and the Shenzhen Stock Exchange (collectively, the "Shanghai/Shenzhen Exchanges"), together with China Securities Depository and Clearing Corporation Limited ("CSDC"), issued the Implementation Rules for the Bond Trading, Depository and Clearing Services for Foreign Institutional Investors (the "Exchange Bond Business Rules") in June 2022.

(2)Invest in the Exchange Bond Market through Intra-Market Connect

Intra-Market Connect herein means interconnection mechanism between CIBM and exchange bond market, which has not been officially implemented yet, and the published rules can be found in the Announcement of the People's Bank of China and the China Securities Regulatory Commission [2020] No.7, the Interim Measures for the Interbank Bond Market and Exchange Bond Market Connect Business, and the FAQ on Interbank-Exchange Bond Market Connect issued by China Foreign Exchange Trade System (“CFETS”) and Shanghai Clearing House.

2.Broaden Scope of Investment

| Investment scope via CIBM Direct before the Announcement[1] |

Sovereign Institutions:

Cash bonds, bond repos, bond lending, bond forwards and FRA, IRS, and other trading permitted by PBOC.

Commercial Institutions:

Cash bonds; Bond lending, bond forwards, FRA and IRS for hedging purpose. Bond repos in CIBM is permissible for overseas RMB clearing banks and participating banks as well. |

| Investment scope allowed by the Announcement |

Cash bonds, bond lending, relevant derivatives for risk-management purpose, bond ETF, and other trading permitted by PBOC or CSRC. |

| Investment scope allowed by the Exchange Bond Business Rules |

Bonds (including convertible bonds and exchangeable bonds), ABS, bond lending, relevant derivatives for risk management purpose, bond funds (including bond ETF), and other fixed-income products such as cash bonds, relevant derivatives and bond fund products approved by CSRC, PBOC or Shanghai/Shenzhen Exchanges. |

Upon comparison, the Announcement basically maintains the original scope of investable investments, but also makes some meaningful additions or adjustments. For example, bond lending is no longer limited to hedging purpose. We understand that:

(1)Until PBOC further clarifies or adjusts the relevant policies, the scope of investments previously available under CIBM Direct will remain unchanged for the time being after the implementation of the Announcement.

(2)The investment scope by investing directly in the exchange bond market shall be governed by the Exchange Bond Business Rules. Among others, if the convertible or exchangeable bonds held by foreign investors need to be converted or exchanged, it shall be done through their QFII/RQFII securities accounts, comply with applicable rules on DOI and shareholding limit on foreign investors.

3.Facilitate Filing Procedures

The entry procedures for foreign institutions have been consistently simplified in the recent years. And the Announcement has summarized and improved a series of policies issued by regulators since 2021.

First of all, foreign investors will enter bond market in China in the name of the corporate entities. For both new foreign investors to be filed with PBOC and existing foreign investors to file new products, there is no need to file with PBOC on a product-by-product basis.

Furthermore, foreign commercial institutions can enter the CIBM by submitting materials electronically to Shanghai branch of PBOC, and sovereign institutions can submit materials directly to PBOC.

4.Two Custody Models Available under CIBM Direct

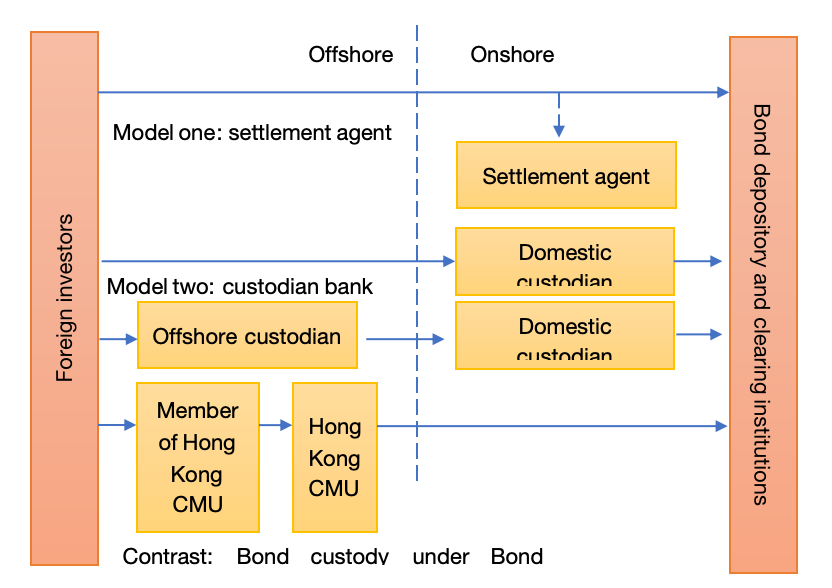

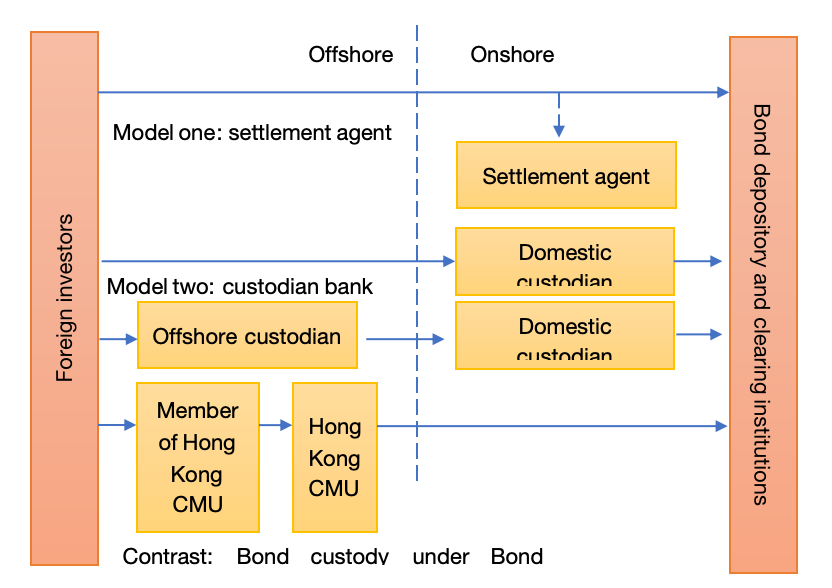

In 2021, authorities in China revealed that China will, while sticking to the basic framework mainly based on single-tier custody model, attempt to settle a comprehensive arrangement compatible for multi-tiered custody model, and permit bonds issuers and investors selecting from the two models. The Announcement has implemented the policies.

Under the settlement agent model, foreign investors can negotiate with the settlement agent on the rights and obligations of both parties, and open bond accounts with bond depository and clearing institutions approved by PBOC. The Announcement once again confirms that Shanghai branch of PBOC no longer requires the submission of agency agreements.

Under custodian bank model, with multi-tiered custody as an option, foreign investors can directly or through their overseas custodian banks engage qualified domestic custodian banks to provide bond custody services.

5.Establish Several Basic Systems under Custodian Bank Model

(1)Multi-tiered Custody

China has gained some experience of multi-tiered custody via Bond Connect between Mainland China and Hong Kong. Northbound Bond Connect adopts such model, with China Central Depository & Clearing Co., Ltd. responsible for first-tier custody and Central Moneymarkets Unit in Hong Kong (“Hong Kong CMU”) responsible for the second-tier custody.

According to the Announcement, multi-tiered custody (i.e., global custodian bank plus domestic custodian bank, which is quite common in foreign markets) is also workable under CIBM Direct. Below is a chart for your easy reference.

(2)Nominal Holding Mechanism

There are less settlement procedures in settlement agent mode adopting single-tier custody, which makes the legal relationships clear and the ownership issue uncontroversial. As for custodian bank mode adopting multi-tiered custody arrangement, CIBM bonds purchased through a domestic custodian bank shall be registered under the name of the domestic custodian bank, according to the Announcement.

Nominal Holding mechanism is prevalent in foreign markets for a quite long time, and has been adopted a lot in the reform and opening-up of China financial industry. For instance, there is nominal holding mechanism in Stock Connect, Bond Connect and Mutual Recognition of Funds between Mainland China and Hong Kong. Hence, relevant market players may be very familiar with it.

The Announcement confirms that foreign investors own the legal rights of the bonds under the muti-tiered custody model. That is to say, foreign investors are the beneficial owners. It is important for regulators in China to confirm this issue and it will help alleviate the concerns of foreign investors.

6.Specify the Responsibility of Domestic Custodian Bank

Offshore custodian bank shall report information on foreign investors and their custodian settlement data in time to domestic custodian bank. It is noteworthy that the 2020 Consultation Paper emphasizes that custodian banks in each level shall sign agreements with banks in the immediate upper- and lower-level and the lower-level custodian bank shall report information and data to upper-level custodian bank, step by step. The Announcement has removed such expression as “step by step”, “upper-level” and “lower level”, which we understand means regulators in China respect business practice in foreign markets by avoiding simple one-size-fits-all rules.

It is stipulated that domestic custodian bank shall establish relevant arrangements to segregate assets of foreign investors, and proprietary assets and various custody assets of domestic custodian bank, and to fulfill the responsibility of independent custody. It helps alleviate the concerns of foreign investors on asset independence.

7.Trading, Depository and Clearing under the Direct Investment in Exchange Bond Market

(1) Relevant Participating Institutions

Foreign investors shall: (i) appoint qualified commercial banks as custodians, (ii) appoint custodians to report basic information of foreign investors to Shanghai/Shenzhen Exchanges, (iii) appoint domestic securities companies with membership of Shanghai/Shenzhen Exchanges as trading participants to participate in bond trading, open securities accounts in accordance with relevant regulations of CSDC, and only one trading participant can be appointed for each securities account, and (iv) appoint domestic securities companies with clearing participation qualification of CSDC to provide clearing service.

(2)Reporting Obligations of the Custodian

The Shanghai/Shenzhen Exchanges may require the corresponding custodian to report the bond holdings of foreign investors in a timely manner for abnormal trading behaviors that may seriously affect the normal trading order or that constitute suspected illegal and unlawful trading; if foreign investors invest in the exchange bond market as asset managers, the Shanghai/Shenzhen Exchanges may require the custodian to report the asset management product’s investors and their bond holdings.

8.Registration and Administration of Foreign Exchange

Previous rules dispersedly exist in official documents and Q&As issued by PBOC and SAFE. The Funds Administrative Provisions unifies and integrates relevant rules, with some improvements. Some key provisions include but not limited to:

(1)Pursuant to international practice, foreign investors can directly register in CPMIS of SAFE through domestic custodian or settlement agent after filling for market entry.

(2)Abrogate the percentage restriction of a single currency (RMB or foreign currency). For foreign investors adopting investing strategy of “RMB and foreign currency”, it only sets a percentage restriction on remitting foreign currency, but with the limit extended from 110% to 120% (Limit on “long-term investors” in the Chinese bond market can be further relaxed).

(3)Formally abrogate limitation on spot foreign exchange settlement through settlement agent. Foreign investors carrying out spot foreign exchange settlement and foreign exchange derivatives transactions can choose to directly do it with the custodian, settlement agent or other domestic financial institutions as a client, or apply to become a member of CFETS and trade via prime brokers. Besides, foreign banks as investors can also choose to apply to become a member of CFETS and trade directly.

(4)For foreign investors carrying out domestic RMB to foreign exchange derivative transactions for hedging purpose, the limit on the number of counterparties (i.e., 3) is abolished.

9.Non-trading Transfer of Bonds and Funds Transferring

PBOC and SAFE have allowed non-transactional transfer of CIBM bonds under CIBM Direct and QFII/RQFII schemes in 2019, and allowed two-way transfer of funds as well.

According to the principle of two-way transfer established in the Announcement, the Exchange Bond Business Rules stipulates in detail that bonds and other securities invested under both QFI/RQFII schemes and other schemes can be transferred in two-way. The scope of such securities however shall be consistent with those stipulated in the Exchange Bond Business Rules, and the domestic custodian shall be obliged to determine the consistency.

According to the principle of two-way transfer established in the Announcement, the Funds Administrative Provisions further clarifies that funds of the same foreign investor in accounts under both QFII/RQFII schemes and other schemes can be directly transferred in two-way and be used for domestic securities investment. The subsequent transactions, and the use and settlement of funds shall follow the relevant requirements of the scheme after such transfer.

10.Observations and Outlook

The series of policies in 2022 is an important push to deepen the system-based opening of China's bond market, which is conducive to shaping a diversified investor community and expanding capital inflows; on the other hand, it is beneficial for accelerating the cultivation of custodian banks with global competitiveness.

In the next phase, it is expected that China will continue to optimize various policies, and relevant financial regulators and self-regulatory organizations will continue to improve supporting rules, to create a more friendly and convenient investment environment, and to support the construction of a high-level financial opening up pattern that meets the requirements of high-quality development.

In addition, the official launching of the Intra-Market Connect between the CIBM and the exchange bond market is also quite anticipated.